PayPal Working Capital

- Flexible payments

- One affordable fixed fee

- No credit check

- Funding in minutes

Why choose PayPal Working Capital?

Funding in minutes

Flexible payments

Minimum payment required.

One affordable fixed fee

No credit check

Funding in minutes

Flexible payments

Minimum payment required.*

One affordable fixed fee

No credit check

Funding in minutes

Apply Now

Simple pricing, simple payments

Get to know the basics.

How much can I receive?

PayPal Working Capital is based on your PayPal sales history, so you receive an amount that fits your business.

There’s no credit check when you apply, so there’s no effect on your credit score.

How much does it cost?

How do I repay?

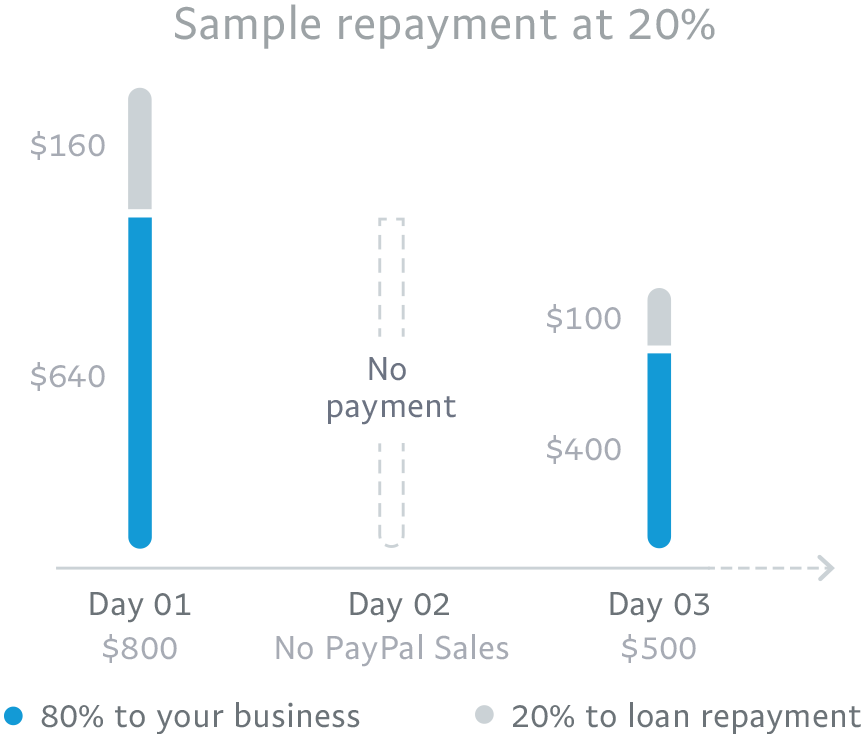

You pay back the loan automatically with a percentage of your sales that you choose when you apply.

The higher your sales, the faster you repay. On days without sales, you won’t pay a thing, but you need to repay a minimum of 5% or 10% every 90 days to keep your loan in good standing.

You can also make manual payments and even pay the loan in full anytime with no early repayment fee.

The PayPal difference

PayPal Working Capital makes it easier for your business to get funding

Frequently Asked Questions

PayPal Working Capital is a business loan with one affordable, fixed fee. You repay the loan and fee with a percentage of your PayPal sales (minimum payment required every 90 days). There are no periodic interest charges, monthly bills, late fees, pre-payment fees, penalty fees, or any other fees.

The process is easy:

Select your loan amount. The maximum loan amount depends on your PayPal account history.

Choose the percentage of your PayPal sales that will go toward repaying your loan and fee.

If approved, receive the funds in your PayPal account within minutes.

Repay automatically with a percentage of each sale until your balance is paid in full (minimum payment required every 90 days). You can also make manual payments or even pay the loan in full with no early repayment fee, using your PayPal balance or a linked bank account.

To be eligible to apply for PayPal Working Capital, you must:

Have a PayPal Business or Premier account for 90 days or more

Process at least $20,000 in annual PayPal sales if you have a Premier account or at least $15,000 in annual PayPal sales if you have a Business PayPal account.

Pay off any existing PayPal Working Capital loan

For many merchants, all you need is some basic info about your business and yourself, as the authorized representative on the account. However, for certain business types, you will want to have additional information on hand. You will need the contact details, birth dates, and Social Security numbers of your primary business owners and business management, as well. These people won’t have access to the account (unless you authorize them on your PayPal account), and the information won’t be used for a credit check.

Unlike traditional loans, PayPal Working Capital charges a single, fixed fee that you’ll know before you sign up. No periodic interest, no hidden fees, and no late fees.

Because your automatic repayments get deducted as a percentage of each PayPal sale, the amount you repay each day changes with your sales volume. The more you sell, the more repayment progress you’ll make that day. On days without sales, you’ll make no payments, but there is a minimum repayment requirement every 90 days.

Depending on the loan terms you choose, you must pay at least 5% or 10% of your total loan amount (loan + the fixed fee) every 90 days.

The 5% minimum applies to loans estimated to take 12 months or more to be repaid, based on your business’ past PayPal sales and other factors. The 10% minimum applies to loans estimated to be repaid within 12 months.

For most of our customers, regular automatic repayments easily cover the minimum and this is never an issue. But if you do get behind, you can make additional payments on the PayPal Working Capital website. Payments can be made using your PayPal balance or a linked bank account.

If you do not meet the minimum and your loan goes into default, your entire balance could become due and limits could be placed on your PayPal account.

Please see Section 12 of the Terms and Conditions to learn more about default.

PayPal Working Capital loans are issued one at a time. You can apply after paying off one loan to get another one – many merchants do. Keep in mind that it can take up to 10 business days for your final payment to process before you’ll be able to apply for a future loan, which will then be subject to approval.

Comments

Post a Comment