While Facebook prepares to offer readers a way to subscribe and pay for news directly from inside its app, the social network continues to tinker with how it presents publishers’ content elsewhere. In the latest development, TechCrunch has learned and confirmed that Facebook has removed Instant Articles — Facebook’s self-hosted, faster-loading article format for mobile — from Messenger.

“As we continue to refine and improve Instant Articles — and in order to have the greatest impact on people and publishers — we’re focusing our investment in Instant Articles in the Facebook core app and are no longer offering Instant Articles in Messenger,” a spokesperson said. “We believe that Messenger is an exciting channel for new and interesting news consumption experiences, including the opportunity to build unique messaging experiences in Messenger that many publishers (including TechCrunch) have executed successfully via the Messenger Platform.”

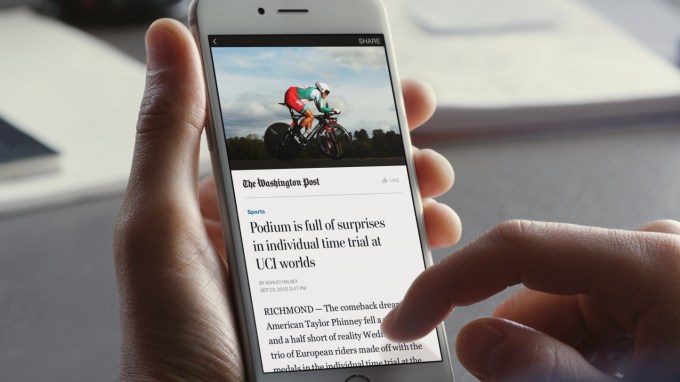

Instant Articles was a pared-down article format launched by the social network in 2015 with the aim of speeding up page load time by ten times compared to the mobile web, thereby cutting down the number of people dropping off when reading on mobile devices. (The “Instant” feel and performance is something that Facebook appears keen to develop: just this week it started to test Instant Videos.)

Originally designed to run in the News Feed, a year ago Facebook expanded Instant Articles to Messenger as part of a wider strategy to enhance content on its popular messaging platform, which today has over 1.2 billion users.

But while Instant Articles does what its name suggests, there have been some teething pains with the format.

Several high profile publications and publishers, including the Guardian, Forbes, Hearst, The New York Times, Bloomberg, the Wall Street Journal, ESPN, CBS News, NPR, Financial Times, and VICE News either pulled, scaled back, or never participated in Instant Articles in the first place because of the lack of monetization on the platform. There have also been issues with traffic reporting with the format.

Facebook has tried to respond to these problems to make it more publisher-friendly. It’s periodically corrected its traffic reports and introduced new analytics tools to measure it better; there are now ‘native ads’ in the format alongside links for further reading; readers can sign up for more content (specifically newsletters) at the bottom of Instant Articles; and to widen the content funnel, Facebook has expanded Instant Articles to support Google AMP and Apple News (two other fast-loading formats for those respective platforms).

From what we understand, though, some attribution issues have remained. Specifically, you can’t easily add UTM parameters to the end of Instant Article URLs to track who is clicking and where traffic is coming from. “Tracking Instant Article content is much more difficult than a traditional link, so brands and publishers are likely finding it hard to gauge traction of the platform,” one source said.

When Facebook first launched Instant Articles in Messenger, some believed that the expansion would help boost the format at a time when the company was de-emphasizing publishers in the News Feed algorithm, putting them behind friends. It’s fair to wonder how and if that boost ever played out.

One thing that appears more clear: Instant Articles — whether on Messenger or not — remain an anchor in how Facebook wants to work with publishers.

In the latest development, the company has confirmed that it is collaborating with publishers on a paid-content model that it will start testing later this year. A report in the WSJ ahead of his announcement described how it will work: readers will be able to subscribe to and pay for publications directly from Facebook’s mobile app (details of pricing are still being worked out), but publishers who want to participate in the paid-content model will have to publish their content natively to Facebook by way of Instant Articles, according to the report.

In other words, for those who have long been asking Facebook to introduce a paid-content model — the idea being this can offset the fact that Facebook likely makes way more in ad revenue than publishers ever will from the content that’s shared and read on there — Instant Articles may become the stick to their revenue carrot.

Comments

Post a Comment