A fork could change the equation for thousands of bitcoin users.

The biggest, newest fear for bitcoin investors and users is a fork.

In financial terms, a fork isn’t for eating — it represents a split in the currency that could significantly destabilize the cryptocurrency’s value by splitting it into two completely different currencies — “bitcoin classic” and “bitcoin current.” Right now, bitcoin’s price has been rising, but come August 1, there’s a small chance its future could change forever. So when will Bitcoin fork, and what does that mean for the future of the currency?

The answer is a bit complicated. To understand it, here’s a rundown of the central problem facing bitcoin and the various ways its software-savvy community is trying to fix it.

The problem

Bitcoin has one central problem — it’s slow as heck. The world’s leading cryptocurrency is crippled by its meager ability to facilitate a mere seven transactions per second. As more and more people buy in and adopt the cryptocurrency, seven transactions per second will become prohibitively slow. For reference, the system that powers Visa credit and debit cards usually sees about 1,700 transactions per second, and has the power to handle 56,000 per second if demand spikes. Sure, there are far more Visa users than bitcoin, but if the currency ever wants to compete with major financial networks it has to find a way to get faster.

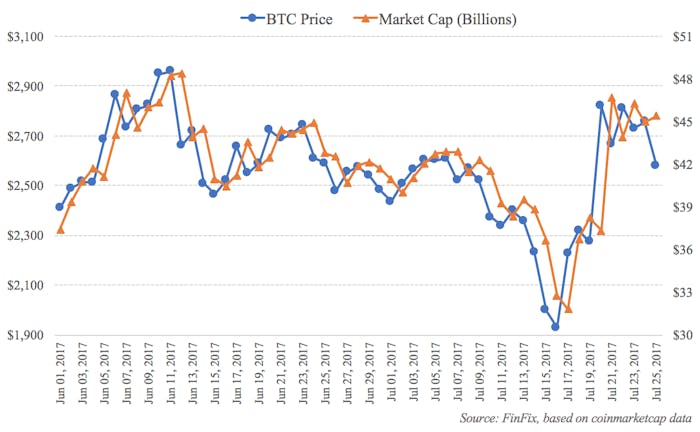

Bitcoin values.

Bitcoin values.

So what’s the fix?

This is where things get controversial. The bitcoin community is divided on how to fix the problem, and if certain solutions go through, it could result in a fork in the currency.

There are two general plans to fix bitcoin, both of which require a significant update to bitcoin’s version of the blockchain, which is the online ledger where all bitcoin transactions are recorded chronologically and publicly.

Every bitcoin transaction takes time, and the system can only handle about seven per second, worldwide.

Every bitcoin transaction takes time, and the system can only handle about seven per second, worldwide.

Every transaction is recorded on a “block”

The blockchain is essentially a constantly-updating registry of every transaction that happens. Every transaction in the blockchain has to be recorded, or written down on a page, called a “block.” Each block contains the same amount of data, and can record the same number of transactions. When it’s filled up, it’s “sealed” and is assigned a unique code that everyone can see as part of the public “chain” of blocks. That way, the registry is public and secure — you can’t go back into the filed away pages and change stuff, because everyone would be able to see it. Sealing a block, however, requires some hefty computing power (it’s a lot of raw number crunching to find the right unique code) but whoever writes that block into the chain gets a reward of some bitcoin for doing the leg work. The people who do this are called “miners.” To further incentivize people to mine, almost all bitcoin transactions include a fee — a service charge to get a miner to devote computer resources to seal your block and write down your transaction. If you offer up a higher transaction fee, a miner’s more likely to get to your transaction first, because they make more money.

A small bitcoin mining bot, basically a bunch of processing power with a big-ass fan used to crank out calculations.

A small bitcoin mining bot, basically a bunch of processing power with a big-ass fan used to crank out calculations.

Cool, so why is bitcoin so slow?

The problem here is that the arbitrary amount of data that each block stores — for bitcoin, it’s one megabyte — is too small. Bitcoin’s creator set the block size small so that the technology wouldn’t be unfair to people with less computing resources (the more powerful computers you have, the faster you can “mine,” and the more money you can make). In order to do more transactions per second, bitcoin’s blockchain needs to figure out a way to either make its blocks bigger, or to streamline the amount of data a transaction takes up so each block can record more transactions. Each of these solutions has big pros and cons for different groups of bitcoin users.

Solution One: Streamline the transactions

The first way to solve the problem and make bitcoin faster is to change the way transactions are recorded to make them take up less data. A huge part of the data in a bitcoin transaction is the Witness/Signature, which basically verifies that the person sending money has the cheddar to afford the requested transaction. One plan, called BIP 91 or SegWit (for segregated witness), would reorganize how blocks are transferred so the witness section is treated as a separate section of data at the end of a transaction, sorta set aside from the data that actually matters, and making it more manageable. This change would be a “soft fork” in the blockchain — a software update that would change how the system works, but would be backwards compatible with the old system, so older blocks would still be valid, and things would more or less stay the same. Critics of this plan say it’s just a stop-gap, and that eventually, bitcoin is still going to have to make a bigger change to get faster.

Some programmers have found ways to make physical representations of bitcoins.

Some programmers have found ways to make physical representations of bitcoins.

Solution Two: Go Big or Go Home

The second solution, favored by what Quartz calls a “vocal faction” of the bitcoin community is to double the size of bitcoin’s blocks, from a one megabyte limit to a two megabyte limit. This would greatly increase bitcoin’s potential transactions speed, but would force a situation called a “hard fork.” The second plan, also known as SegWit2X, would build on the first solution, using the segregated witness fix but also making the blocks themselves way bigger. It would force every miner to adopt a major software update to use the SegWit 2X (we’ll call it BigBlock) system, or else be left behind mining bitcoins on an old version of the software.

Since bitcoin is a decentralized, free-market system, there would certainly be miners who don’t want to switch, or can’t switch, because they don’t have the computing resources to keep up with the demands of BigBlock. And the new system wouldn’t be backwards compatible, meaning that any new coins mined in the BigBlock system wouldn’t be valid on the classic blockchain. This is pretty much what happened to Ethereum, another cryptocurrency, which now has two versions — Ethereum, and Ethereum Classic. Any Ether (the name of the currency) that people mined before the fork still works on both systems, but the two current currencies are now incompatible. A bitcoin hard fork would be similar, creating one new and improved currency and leaving a lot of the little guys behind.

Mohit Mamoria, in his exhaustive breakdown earlier this month for The Next Web, summed up why this is a problem.

Due to the fact that not everyone will have enough money to upgrade their computation power to mine larger blocks profitably, smaller miners will vanish away from the network. This will leave larger and fewer miners in the network — which dramatically reduces the competition.

When Satoshi Nakamoto [the creator of Bitcoin] [presented](https://bitcoin.org/bitcoin.pdf) the glorious idea of building a decentralized future, he didn’t mean it just in theory, but he meant it in practice. Putting power in the hands of few large miners goes against the foundational idea of bitcoin’s existence.

Wow, that’s a lot. What’s happening now?

As it stands, it appears that the bitcoin mining community is going for plan number one, or BIP 91. Some 97 percent of miners signaled their support for BIP 91, effectively locking in the change. Still, the miners have until August 1 to formally adopt the policy, meaning at least 51 percent of active miners must be using the software. It looks like that’s going to go through — Bitcoin.com reports that 88.2 percent of the mining community has said they’re ready to activate SegWit.

The future of the currency, however, is still very much in flux. A fringe element sponsored by the Chinese bitcoin exchange slash mining group ViaBTC is trying to push through a “user activated hard fork,” by creating a spinoff currency called Bitcoin Cash, or BCC. This, took, could all go down on August 1, so whatever happens, the next few days are going to be very interesting for everyone even somewhat invested in the future of magic internet nerd money. Stay tuned.

Comments

Post a Comment